| Humana Inc. 500 West Main Street Louisville, Kentucky 40202 |

(Top Photo: Kurt Hilzinger; Bottom Photo: Bruce Broussard) | Dear Fellow Stockholders:

We would like to invite you to attend the Annual Meeting of Stockholders of Humana Inc., to be held on Thursday, April

This proxy statement contains information about our Company and the

This year, we will once again be taking advantage of U.S. Securities and Exchange Commission (SEC) rules that allow us to furnish proxy materials to our stockholders on the Internet. These materials will be available on the Internet on or about March

We hope you can attend the meeting. However, even if you are unable to join us, we urge you to still exercise your right as a stockholder and vote by telephone, mail or using the Internet. The vote of every stockholder is important.

This proxy statement is being mailed or transmitted on or about March | |||

2023 Reflections

|

For our Company and our stakeholders, 2023 was a dynamic and challenging year as we found ourselves responding to significant and unanticipated increase in medical cost trends in the Medicare Advantage (MA) industry. Throughout the year, we leveraged our commitment to cost discipline, working tirelessly to offset the impact of these trends through areas such as administrative cost containment and productivity initiatives. Despite our efforts, we were ultimately unable to fully offset these trends as they continued to accelerate in the fourth quarter, resulting in 2023 earnings growth that failed to meet our expectations. Like you, we were disappointed in the Company’s closing financial performance. Still, we do not want this setback to overshadow the advancement of our long-term strategy in 2023 - achieving strong growth in our individual MA, Medicaid and CenterWell businesses, progress made across the enterprise to grow our industry leading MA and senior focused value-based care platforms and maintain our industry leading quality and customer satisfaction scores to name just a few.

Insurance. The strength of our core insurance operations remains clear. In 2023, we grew our individual MA membership by over 840,000, and continued our leadership in putting members first - evidenced again in our strong Star Ratings for 2024, with 94 percent of our members in plans rated 4 stars or higher, 61 percent in plans rated 4.5 or 5 stars, and 37 percent of all 5-star MA membership in a Humana plan. And our strong organic Medicaid growth continues - we implemented contracts in Ohio and Louisiana in 2023 and look forward to beginning to serve members in both Indiana and Oklahoma in 2024 - reflecting our strong operating model and ability to deliver unique value to communities.

CenterWell.The growth of both our primary care and value-based home health businesses continues. In primary care, we now operate nearly 300 centers serving over 294,000 patients, which represents year over year growth of 26 percent and 19 percent, respectively. And we have further expanded our value-based home care models, now covering 843,500 of our MA members under a value-based payment model covering home health, DME and infusion services. And with this growth, we continue to unlock opportunities for our health plan members to utilize our healthcare services assets, which leads to better outcomes, greater satisfaction, and higher customer retention.

As your Board of Directors, we take our responsibilities very seriously and are committed to representing our stockholder’s interests to deliver sustainable results over the long-term. As the Company continues to navigate a complex and dynamic period of change in the MA industry in the near-term, we still believe in the strong fundamentals and significant value proposition of MA and remain focused on both margin recovery and advancing our industry leading MA and senior focused value-based care platforms to position the Company for long-term success. At the same time, the Board continues to observe comprehensive corporate governance practices, working together closely as we execute on our CEO transition plan, engaging with stockholders to understand and be responsive to your perspectives, and providing active oversight to assist the Company in advancing its strategic vision.

On behalf of the Board, thank you for your investment and continued confidence in Humana’s success.

Kurt J. Hilzinger Chairman of the Board and Stockholder

March

|

Bruce D. Broussard Director, and Stockholder

March |

Notice of 20222024 Annual Meeting of Stockholders

| Time and Date: | ||

| Location: | ||

| Agenda: | 1. Elect the

2. Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for

3. Non-binding advisory vote to approve the compensation of the Company’s Named Executive Officers.

4. Approve amendment to the Company’s Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted by Delaware law. 5. Approve amendment to the Company’s Restated Certificate of Incorporation to eliminate supermajority voting requirement in connection with certain transactions. 6. Consider and vote upon the stockholder proposal set forth in this proxy statement, if properly presented at the meeting. 7. Consider any other business properly brought before the meeting. | |

| Record Date: | February | |

| Proxy Voting: | Your vote is important so that as many Shares as possible will be represented. Please vote by one of the following methods:

• BY INTERNET

• BY TELEPHONE

• BY RETURNING YOUR PROXY CARD (if you elected to receive printed materials)

• BY VOTING DURING THE ANNUAL MEETING

See instructions on your proxy card or at the voting site (www.proxyvote.com). | |

By Order of the Board of Directors,

Joseph M. Ruschell

Associate Vice President, AssistantAssociate General Counsel & Corporate Secretary

March 9, 20228, 2024

| i | ||||||

| 1 | ||||||

4 | ||||||

| Corporate Governance | 15 | |||||

| 41 | ||||||

| 44 | ||||||

| Organization & Compensation Committee Report | ||||||

| 66 | ||||||

| Executive Compensation | 67 | |||||

| Certain Transactions with Management and Others | ||||||

| Audit Committee Report | ||||||

Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm

|

|

85 |

| |||

Proposal Three:Non-Binding Advisory Vote with Respect to the Compensation of the Company’s Named Executive Officers

|

|

86 |

| |||

87 | ||||||

89 | ||||||

91 | ||||||

| Frequently Asked Questions | ||||||

| Additional Information | 100 | |||||

| Annex I | A-I-1 | |||||

| Annex II | A-II-1 | |||||

| Annex III | A-III-1 | |||||

General Information

Meeting: | Place: | ||||||

Date: | Thursday, April | ||||||

Time: | |||||||

Record Date:

| February | ||||||

How to Vote Your Shares

You may vote if you were a stockholder as of the close of business on February 28, 2022.29, 2024.

| Online www.proxyvote.com |  | By Mail Complete, sign, date, and return your proxy card in the envelope provided | |||

| By Phone Call the phone number located on the top of your proxy card |  | During the Meeting Attend our virtual annual meeting and cast your vote | |||

Voting Overview

Items of Business

| ||||||||||||||

Items of Business

| ||||||||||||||

Items of Business | Items of Business | Board Recommendation | Page Reference | Board

|

| Page Reference

| ||||||||

1.

| Elect the thirteen (13) director nominees named in the proxy statement.

| FOR

| 30

|

Elect the eleven (11) director nominees named in the proxy statement.

|

FOR

| 4

| ||||||||

2. | Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2022.

| FOR | 82 | Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024.

| FOR | 85 | ||||||||

3. | Non-binding advisory vote to approve the compensation of the Company’s Named Executive Officers.

| FOR | 83 | Non-binding advisory vote to approve the compensation of the Company’s Named Executive Officers.

| FOR | 86 | ||||||||

4.

| Consider any other business properly brought before the meeting.

| Approve amendment to the Company’s Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted by Delaware law.

| FOR | 87 | ||||||||||

5.

| Approve amendment to the Company’s Restated Certificate of Incorporation to eliminate supermajority voting requirement in connection with certain transactions.

| FOR | 89 | |||||||||||

6.

| Consider and vote upon the stockholder proposal set forth in this proxy statement, if properly presented at the meeting.

| AGAINST | 91 | |||||||||||

7.

| Consider any other business properly brought before the meeting.

| |||||||||||||

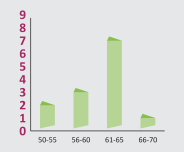

Board of Directors Nominees

| Name | Position | Age | First Elected Director | |||

Kurt J. Hilzinger | Chairman of the Board, Independent Director |

| 07/2003 | |||

Bruce D. Broussard | Director, |

| 01/2013 | |||

Raquel C. Bono, M.D. | Independent Director |

| 09/2020 | |||

Frank A. D’Amelio | Independent Director |

| 09/2003 | |||

David T. Feinberg, M.D. | Independent Director |

| 03/2022 | |||

Wayne A.I. Frederick, M.D. | Independent Director |

| 02/2020 | |||

John W. Garratt | Independent Director |

| 02/2020 | |||

|

|

|

| |||

Karen W. Katz | Independent Director |

| 09/2019 | |||

Marcy S. Klevorn | Independent Director |

| 02/2021 | |||

|

|

|

| |||

Jorge S. Mesquita | Independent Director |

| 02/2021 | |||

| Independent Director |

|

| |||

| i | Humana | |

Why am I receiving this Proxy Statement?

You are receiving a proxy statement because you owned Humana Inc. common stock, which we refer to as Shares, as of Monday, February 28, 2022, which we refer to as the Record Date, and that entitles you to vote at the Annual Meeting. Our Board of Directors has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Board’s solicitation of proxies on behalf of the Company for use at our 2022 Annual Meeting of Stockholders. Your proxy will authorize specified people (proxies) to vote on your behalf at the Annual Meeting. By use of a proxy, you can vote, whether or not you attend the meeting.

This proxy statement describes the matters on which the Company would like you to vote, provides information on those matters, and provides information about the Company that we must disclose when we solicit your proxy.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. We believe that Internet delivery of our proxy materials allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice, to our stockholders and beneficial owners as of the Record Date. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found on the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis by calling Broadridge Financial Solutions, Inc., or Broadridge, at 1-800-579-1639.

How can I get electronic access to the proxy materials?

The Notice provides you with instructions regarding how to:

View our proxy materials for the Annual Meeting on the Internet; and

Instruct us to send our future proxy materials to you electronically by e-mail.

Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of our Annual Meetings on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

When and where is the Annual Meeting?

The Annual Meeting will be held on Thursday, April 21, 2022, at 9:30 a.m., Eastern Time, at the Company’s headquarters, located at 500 West Main Street, 25th Floor Auditorium, in Louisville, Kentucky.

Who is entitled to vote?

Anyone who owns Shares, as of the close of business on February 28, 2022, the Record Date, is entitled to vote at the Annual Meeting or at any later meeting should the scheduled Annual Meeting be adjourned or postponed for any reason. As of the Record Date, 126,743,282 Shares were outstanding and entitled to vote. Each Share is entitled to one vote on each of the matters to be considered at the Annual Meeting.

|

What will I be voting on?

Election of the thirteen (13) director nominees named in this proxy statement to serve on the Board of Directors of the Company;

Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2022; and

A non-binding, advisory vote to approve the compensation of the Company’s Named Executive Officers as disclosed in this proxy statement.

The Board of Directors is not aware of any other matters to be presented for action at the Annual Meeting. However, if other matters are properly presented for a vote, the proxies will be voted for these matters in accordance with the judgment of the persons acting under the proxies.

How does the Board recommend I vote on each proposal?

The Board recommends that you vote your Shares as follows:

FOR the election of each of the thirteen (13) director nominees named in this proxy statement;

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2022; and

FOR the approval of the compensation of the Company’s Named Executive Officers as disclosed in this proxy statement.

All Shares that are represented at the Annual Meeting by properly executed proxies received before or at the Annual Meeting and not revoked will be voted at the Annual Meeting in accordance with the instructions indicated in the proxies.

How do I participate in the Annual Meeting?

This year’s Annual Meeting will be held in-person at the Company’s headquarters located at 500 West Main Street, 25th Floor Auditorium, in Louisville, Kentucky. The Company will also provide a live audio-only webcast of the Annual Meeting via the Internet on the Investor Relations section of the Company’s website (www.humana.com). You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on the Record Date, or hold a valid proxy for the meeting. If you decide to attend the Annual Meeting by webcast, you will be able to listen to the Annual Meeting but will not have the ability to vote your shares or ask questions during the Annual Meeting. Conversely, if you are attending in-person, you will have the ability to ask questions and vote your Shares during the Annual Meeting. The Company will provide Rules of Conduct for the Annual Meeting which can be obtained at www.proxyvote.com after logging in with your unique 16-digit control number provided on your Notice of Internet Availability of Proxy Materials, your proxy card or your voting instruction form that accompanied your proxy materials (your “Control Number”). The Rules of Conduct will be strictly adhered to during the Annual Meeting.

If you are a beneficial stockholder, you may contact the bank, broker or other institution where you hold your account if you have questions about obtaining your Control Number. Non-stockholders are welcome to attend the Annual Meeting, however guests will not be allowed to participate during the Annual Meeting except as listeners.

A question and answer (Q&A) session will be available to stockholders during the Annual Meeting and will include questions submitted in advance of, and questions asked in person during, the Annual Meeting. You may submit a question in advance of the meeting at www.proxyvote.com after logging in with your Control Number. Questions may be submitted in person during the Q&A session of the Annual Meeting. The Company’s Corporate Secretary will review all questions submitted in advance to ensure that those presented for response are in accordance with the Rules of Conduct.

How do I vote?

There are four ways that you can vote your Shares. Voting by any of these methods will supersede any prior vote you made regardless of how that vote was made. PLEASE CHOOSE ONLY ONE OF THE FOLLOWING:

|

|

|

|

|

How will my Shares be voted if I do not specify how they should be voted?

If you sign and return your proxy card without indicating how you want your Shares to be voted, the persons acting under the proxies will vote your Shares as follows:

FOR the election of each of the thirteen (13) director nominees named in this proxy statement;

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2022; and

FOR the approval of the compensation of the Company’s Named Executive Officers as disclosed in this proxy statement.

What if my Shares are not registered in my name?

If you own your Shares in “street name,” meaning that your bank, broker or other nominee is actually the record owner, you should receive the Notice and voting instruction card from your bank, broker or other nominee. In addition, stockholders may request, by calling Broadridge at 1-800-579-1639, to receive proxy materials in printed form, by mail or electronically by e-mail, on an ongoing basis. When you own your Shares in street name, you are deemed a beneficial owner or holder for voting purposes and you may not vote your Shares at the Annual Meeting unless you receive a valid proxy from your brokerage, firm, bank, broker-dealer or other nominee holder.

If you hold Shares through an account with a bank, broker or other nominee and you do not provide voting instructions on your instruction form, your Shares may not be voted by the nominee with respect to certain proposals, including:

the election of directors;

the approval of the compensation of the Company’s Named Executive Officers as disclosed in this proxy statement; and

the frequency with which future non-binding advisory stockholder votes on the compensation of the Company’s Named Executive Officers will be held.

Banks, brokers and other nominees have the authority under the regulations of the New York Stock Exchange, or the NYSE, to vote Shares for which their customers do not provide voting instructions only on certain “routine” matters, including the ratification of the appointment of the Company’s independent registered public accounting firm. However, the proposals listed above are not considered “routine” matters for this purpose, and therefore your Shares will not be voted with respect to such proposals if you do not provide voting instructions on your instruction form.

|

How many votes are required to approve each proposal, what are the effects of abstentions and unmarked proxy cards, and is broker discretionary voting allowed?

|

|

|

|

| ||||

|

|

| ||||||

| ||||||||

|

|

|

|

What is a “broker non-vote”?

A broker non-vote occurs when a broker or other NYSE member organization holding Shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner, but does have discretionary voting power over other items and submits votes for those matters. As discussed above, if you hold Shares through a broker or other NYSE member organization and do not provide voting instructions to your broker or other NYSE member organization, your Shares may not be voted with respect to certain proposals, including the proposals listed above that are not considered routine.

What is a “quorum”?

A “quorum” is a majority of the issued and outstanding Shares entitled to vote at the Annual Meeting. Shares may be voted at the Annual Meeting by a signed proxy card, by telephone instruction, or electronically on the Internet. There must be a quorum for the Annual Meeting to be held. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining whether a quorum exists.

|

How do I vote the share equivalent units held in the Humana Common Stock Fund of the Humana Retirement Savings Plan or the Humana Puerto Rico Retirement Savings Plan?

If you have an interest in the Humana Common Stock Fund of the Humana Retirement Savings Plan or the Humana Puerto Rico Retirement Savings Plan on the Record Date, you may vote. Under the Humana Retirement Savings Plan and the Humana Puerto Rico Retirement Savings Plan, your voting rights are based on your interest, or the amount of money you and the Company have invested in your Humana Common Stock Fund.

You may exercise these voting rights in almost the same way that stockholders may vote their Shares, but you have an earlier deadline, and you should provide your voting instructions to Broadridge. Broadridge will aggregate the votes of all participants and provide voting information to the Trustee for the applicable plan. If your voting instructions are received by 11:59 p.m., Eastern Time, on Wednesday, April 13, 2022, the Trustee will submit a proxy that reflects your instructions. If you do not give voting instructions (or give them later than that time), the Trustee will vote your interest in the Humana Common Stock Fund in the same proportion as the Shares attributed to the Humana Retirement Savings Plan, or the Humana Puerto Rico Retirement Savings Plan, as applicable, are actually voted by the other participants in the applicable plan.

You must provide your instructions to Broadridge by using the Internet, registered holder telephone number (1-800-690-6903) or mail methods described above. Please note that you cannot vote during the Annual Meeting. Your voting instructions will be kept confidential under the terms of the Humana Retirement Savings Plan or the Humana Puerto Rico Retirement Savings Plan, as applicable.

Who will count the votes?

Broadridge will tabulate the votes cast by proxy, whether by proxy card, Internet or telephone. Additionally, the Company’s Inspectors of Election will tabulate the votes cast at the Annual Meeting together with the votes cast by proxy.

How do I change my vote or revoke my proxy?

You have the right to change your vote or revoke your proxy at any time before the Annual Meeting.

Your method of doing so will depend upon how you originally voted (a later vote will supersede any prior vote you made regardless of how that vote was made):

|

|

|

|

What is the due date for stockholder proposals, including stockholder nominees for director, for inclusion in the Company’s proxy materials for the 2023 Annual Meeting?

Stockholder proposals, or stockholder nominees for director at the 2023 Annual Meeting, as permitted by SEC regulations for inclusion in our proxy materials relating to the 2023 Annual Meeting, must be submitted to the Corporate Secretary in writing no later than November 9, 2022. Proposals should be submitted to the attention of the Corporate Secretary, Humana Inc., 500 West Main Street, 21st Floor, Louisville, Kentucky 40202. Further, to comply with the universal proxy rules (once effective), stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than February 20, 2023.

|

May a stockholder present a proposal not included in our Proxy Statement at the April 21, 2022, Annual Meeting?

A stockholder can present a proposal at the Annual Meeting (a so-called “floor resolution”) only if certain notice requirements are met. The SEC does not directly regulate meeting conduct. State law imposes only limited requirements, so meetings are governed by procedures set forth in our Amended and Restated Bylaws (the “Bylaws”). Humana’s Bylaws require that a stockholder provide written notice of intent to bring a proposal no less than 60 days or more than 90 days prior to the scheduled date of the Annual Meeting of stockholders. If less than 70 days’ notice of the Annual Meeting is given, written notice by a stockholder would be deemed timely if made no later than the 10th day following such notice of the Annual Meeting. A proposal must also meet other requirements as to form and content set forth in our Bylaws. Stockholder proposals should be sent to the attention of the Corporate Secretary, Humana Inc., 500 West Main Street, 21st Floor, Louisville, Kentucky 40202. A copy of our Bylaws is available on our website. From the www.humana.com website, click on “Investor Relations,” and then click on “Corporate Governance” subcategory and then click on the link entitled, “Bylaws.”

How will Humana solicit votes and who pays for the solicitation?

We have engaged D. F. King & Co., Inc. to assist in the distribution of proxy materials and solicitation of votes for approximately $13,000 plus expenses. We have also engaged Broadridge to assist in the distribution of proxy materials and the accumulation of votes through the Internet, telephone and coordination of mail votes for approximately $321,350 plus expenses. We will reimburse banks, brokers and other nominees for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to our stockholders.

How can I obtain additional information about the Company?

Included with this proxy statement (either in printed form or on the Internet) is a copy of our Annual Report on Form 10-K for the year ended December 31, 2021, which also contains the information required in our Annual Report to Stockholders. Our Annual Report on Form 10-K and all our other filings with the SEC also may be accessed via the Investor Relations section on our website at www.humana.com. We encourage you to visit our website. From www.humana.com click on “Investor Relations,” then click on the “SEC Filings and Financial Reports,” then click on the “Annual Reports” subcategory.

Where can I find voting results for this Annual Meeting?

The voting results will be published in a current report on Form 8-K which will be filed with the SEC no later than four business days after the Annual Meeting. The Form 8-K will also be available on our website. From the www.humana.com website, click on “Investor Relations,” then click on “SEC Filings and Financial Reports,” and then click on “SEC Filings” subcategory.

What is “householding”?

“Householding” occurs when a single copy of our Annual Report, proxy statement and Notice is sent to any household at which two or more stockholders reside if they appear to be members of the same family. Although we do not “household” for registered stockholders, a number of brokerage firms have instituted householding for Shares held in street name. This procedure reduces our printing and mailing costs and fees. Stockholders who participate in householding will continue to receive separate proxy cards, and householding will not affect the mailing of account statements or special notices in any way. If you wish to receive separate copies of our Annual Report, proxy statement or Notice in the future, please contact the bank, broker or other nominee through which you hold your Shares.

|

Headquartered in Louisville, Kentucky, Humana Inc. (NYSE: HUM) is a leading (2021 Fortune #41 ranking) health and well-being company focused on making it easy for people to achieve their best health with clinical excellence through coordinated care. We operate under two distinct segments: Insurance and CenterWell – a simple structure that we believe creates greater collaboration across the Insurance and CenterWell businesses and will accelerate work to centralize and integrate operations within the organization. Our strategy integrates care delivery, the member experience, and clinical and consumer insights to encourage engagement, behavior change, proactive clinical outreach and wellness for the millions of people we serve across the country. As of December 31, 2021,2023, we had approximately 17.116.9 million members in our medical benefit plans, as well as approximately 5.34.9 million members in our specialty products.

Our Strategy

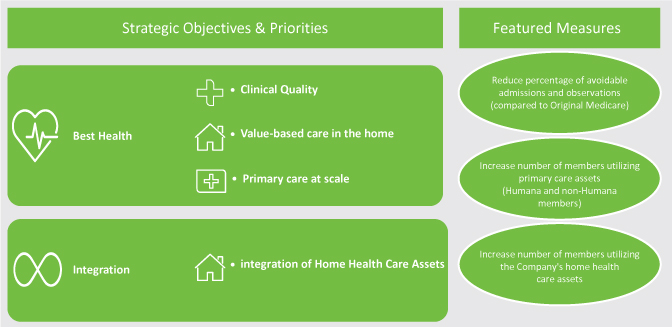

We are committed to addressing the most important health needs of our millions of medical and specialty insurance members and health services patients. Our Insurance segment delivers products that aim to provide affordable, high-quality access to medical, dental, hearing, vision, and prescription drug care to our members. Our CenterWell segment delivers health services to customers to simplify achieving betterfrom a variety of payors, including Humana, in what we consider the most significant areas of influence for managing chronic conditions and total cost of care. These include primary care, home health, and give our customers more healthy days. We offer insurancepharmacy solutions. Together these offerings, underpinned by leading data, analytics, clinical quality, and non-insurance productscommercial capabilities, enable us to consumers through our various subsidiaries. Our medical and specialty insurance products allow members to access health care services primarily through our networks of health care providers with whom we have contracted. In addition, we offer pharmacydeliver solutions provider services, home solutions services and other services and capabilities tothat promote wellness and advance population health.

Our successfulThe core franchise of our business is Medicare Advantage, which is one of the fastest growing and most attractive segments of healthcare. We aim to sustainably and profitably grow this business over the long-term by leveraging several differentiated capabilities in our Insurance segment, including our leadership in value-based care arrangements, our leading clinical quality as evidenced by our consistently high Star Ratings performance, our first-mover advantage in interoperability, data, and analytics solutions, and our award-winning customer experience. We also have an attractive diversification of insurance offerings across product offerings (medical, dental, vision, hearing, prescription drug), and customer segments (Medicare Advantage, Medicaid, and Military). We also realize that in our complex industry effective partnership is required to meet the needs of our diverse customers. We have a proud history inof partnering with multiple stakeholders, including our government partners at the Centers for Medicare & Medicaid Services (CMS), state insurance and Medicaid administrations, distribution and channel partners, care delivery providers, technology companies, and retailers to name just a few.

Our CenterWell segment includes health service offerings of significant scale and scope across primary care, home health, and pharmacy solutions. These capabilities are poised to benefit from secular tailwinds and become an increasingly important piece of the enterprise’s overall revenue and profitability profile. These businesses also expand our addressable market by serving patients from multiple health plans and Original Medicare in addition to Humana health plan administration is helpingmembers. And most importantly, these businesses enable us to participate directly in the areas of highest influence for successful proactive management of disease progression. As a result, we are able to lower avoidable hospital admissions (and readmissions) and lower inappropriate ER utilization while improving net promoter score (NPS) and quality scores relative to competitive benchmarks.

While our businesses have attractive revenue, margin, and growth profiles in their own right, the collection of assets we’ve assembled at meaningful scale position us to create a new kind of integrated care delivery system with the power to address our customers’ most significant needs that impede simpler health care and better health by (i) making care more predictable, understandable, and affordable, (ii) addressing medical, behavioral, and social needs, and (iii) delivering care whenever and wherever our customers need it. Our efforts are leading to a better quality of life for people with Medicare, families, individuals, military service personnel, and communities at large. Humana’s innovative strategy continues to capitalize on industry changes by positioning ourselves as a partner in health and aging to our consumers. We understand that health care is complicated and dealing with multiple physicians and other health care professionalsnavigating the system can be a confusing and daunting task. This is particularly true for vulnerable populations, which tend to over index in the markets we serve. That is one of the principal reasons why Humana continues to enhance its integrated care delivery strategy in key areas to enable a better and more seamless locally delivered health care experience for our members.

We also understand we operate in an increasingly competitive environment, and as such, we are focusingcontinually focused on better understanding and addressing the unmet needs that matter the most to our customers, aligning our actions and behaviors to go above and beyond to solve those needs and deliver on a “more human” experience, so people get more than they expect, ultimately helping members achieve their best health.customers. We call this delivering “human care.” Human care separates Humana from other traditional insurancehealthcare companies, demonstrating that our approach is more caring, personalized, and easier.simple. We do this by (i) listening to our customers, (ii) establishing strong partnerships with trusted individuals who are involved in their care, such as providers and caregivers, (iii) developing technologies and other solutions that offer convenient and easy ways for them to engage with their health, and (iv) leveraging data, analytics, and digital solutions to improve how they engage and interact with usus.

Finally, we aim to be responsible stewards, driven by personalizingsustainable organic growth, expense discipline, and accretive M&A. We also plan to continue to innovate with our government partners to advance the experience for how they want to interact with Humana.

Our ecosystem of value-based care delivery capabilities engages our customers clinically by focusing on the physical, mental,Medicare Advantage and preventative aspects of their health, and delivering better health outcomes. We activate a network of proprietary and partnered solutions, focusing specifically on the highest influence touchpoints of the health care delivery system, including primary care, home health, pharmacy, behavioral health, and social determinants of health. We support the integration of these touchpoints through robust data, analytics, and digital health capabilities that help us engage our customers in their health and get them the right care, in the right place, at the right time. This approach allows usMedicaid programs to deliver better quality and healthgreat outcomes while making the health care experience simpler for our members and patients.

Our Continued COVID-19 Response

Throughout 2021,patients and great value to the COVID-19 pandemic continued to present unique challenges that highlighted our commitment to quality, the strengthstaxpayer in one of the Medicare Advantage (MA) program,finest examples of public/private partnership in the country. And last, and the value that this enduring public-private partnership bringsmost fundamental to our nation’s seniors,strategy, is the disabled andcontinual focus on nurturing the healthcare system as a whole. Early in the year, we activated our teams to support our members in getting vaccinated, leveraging our data, analytics and clinical capabilities to engage in proactive outreach to help our members schedule appointments, partnering with retail organizations, providers and the communities we serve in setting up vaccine clinics, and ensuring that underserved populations had equal opportunities to access the vaccines. As the year progressed, we continued to adapt to address our members’ needs, providing resources regarding the safety and efficacyculture of the vaccines, reducing financial barriers to care, further improving access to telephonicCompany and in-home care and screening capabilities, supporting our members in receiving in-person care, and addressing social determinants of health needs that were exacerbated by the pandemic.

These efforts and our performance in 2021 were made possible by the ongoing, tireless effortsengagement of our associates, who continuedwhich power all of our efforts to put ourdeliver the best health and simplest experience possible for the members and patients at the front of everything we do while continuingare privileged to balance the daily challenges presented by the pandemic.serve.

Company Overview•

|

Our Values

As our industry has evolved, so has our Company, and our values reflect who we are today. While we have always been grounded in our purpose of helping people, we introduced “health first” in 2023 as our evolved purpose, unifying us in our mission of providing simple, personalized and integrated care to all those we serve. It guides our actions as we execute on our strategy and gives us an edge in a competitive environment. When we do it well, our business thrives, our associates are engaged and our customers experience human care.

|  |  |

Our purpose comes alive in clear and simple values that are expressed in unique ways each day. By being caring, curious and committed, our associates reflect who we are and how we show up each day. These values drive behaviors that help our associates put health first for themselves, each other and the people they serve.

|

|

| ||||||

Caring | Curious | Committed | ||||||

| Create an environment where people feel valued, respected and are treated with kindness. | Work and learn together creating the best solutions for the people we serve. | To fulfill our purpose, take bold action to impact the lives of people and transform the healthcare industry. | ||||||

• Empathize and actively listen • Build trust, safety and equitable opportunities • Care for the whole person | • Pursue diverse perspectives • Create value through innovating simple, quality experiences • Integrate our work across the enterprise | • Deliver our commitments with excellence • Be a good steward of our resources and time • Elevate our agility |

| 2 | Humana | 2024 Proxy Statement •Company Overview |

Our Performance

Our 20212023 performance reflected the emergence of a complex and dynamic period of change in the Medicare Advantage industry. While we made strong progress in advancing our senior focused, value-based care platforms and positioning the Company for success over the long-term, we were also confronted with unprecedented increases in medical cost trends that we were ultimately unable to fully offset, resulting in final financial results reflect strong core performance:performance below our expectations.

2023 Business and Financial Performance Results

| • |

|

We returned approximately $354 million to our stockholders in the form of dividends, representing an increase of $31 million over fiscal year 2020;

Over 97% of our Medicare Advantage members in 2021 were in a plan with a 4-Star rating or higher for 2022 and we’ve increased the number of contracts that received a 5-Star rating from 1 contract in 2021 to 4 contracts in 2022 - the most in our history;

We grew our Individual Medicare Advantage membership by 446,400 members, or 11.3%, in 2021, from 3,962,700 members as of December 31, 2020, to 4,409,100 members as of December 31, 2021, with enrollment in our dual eligible special needs plans (D-SNP) growing by more than 40% in 2021, and enrollment in our Humana Honor plan designed for Veterans, that is also available to all Medicare eligibles, growing by 80% in 2021;

We accelerated the growth of our senior-focused, value-based primary care organization, the largest in the nation, ending 2021 with more than 200 centers serving approximately 350,000 patients across 24 markets in 9 states;

We saw continued growth in our pharmacy business, with our Pharmacy Benefit Manager (PBM), the fourth largest in the country, processing 515 million 30-day equivalent scripts in 2021, an 8 percent increase year over year; and

We became the largest home health and hospice organization in the nation through the completion of our acquisition of Kindred at Home, and made substantial progress towards our goal of scaling and maturing a risk-bearing, value-based model that manages the provision of home health, durable medical equipment (DME) and home infusion services.

| • | Returned approximately $2.0 billion to our stockholders in the form of dividends and stock repurchases.** |

| • | Grew our individual Medicare Advantage membership by 843,300 members, representing 18.5% growth over fiscal year 2022. The Company continues to demonstrate individual MA membership growth above the industry average, with a three-year compound annual growth rate of 11%. |

| • | Remained the industry-leader in Star Ratings among our publicly traded peers for the sixth consecutive year, with 94% of our Medicare Advantage members enrolled in 4-star and above contracts,*** 61% of members in 4.5 and 5-star contracts, and four of our contracts receiving a 5-star rating. |

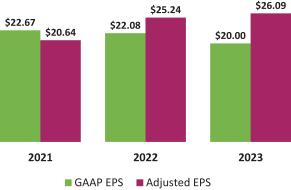

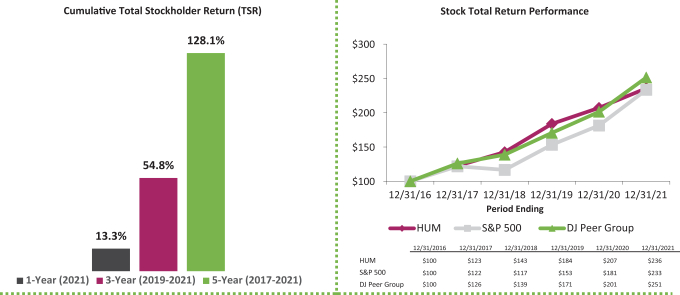

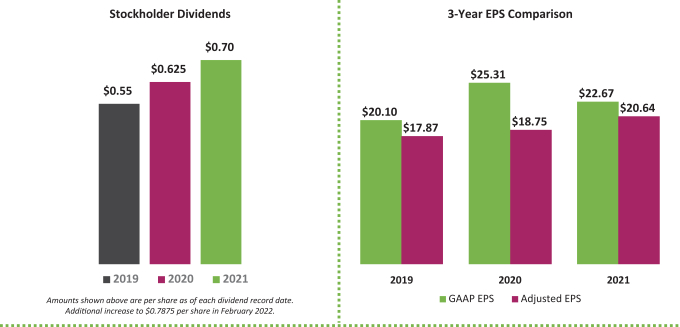

Stockholder Dividends | 3-Year EPS Comparison | |

|  |

The footnotes below are referenced throughout this proxy statement.

| * | Please refer to |

| ** | Stock repurchases includes $73 million in connection with employee stock plans. |

| *** | Membership totals in MA plans with 4+ Star Rating reflect membership as of October 2023 when Star Ratings were released by the Centers for Medicare & Medicaid Services (CMS). |

|

|

| ||||||||||||||||

|

|

| ||||||||||||||

|

|

|

| |||||||||||||

|

|

|

|

| ||||||||||||

| ||||||||||||||||

The goal of these processes is to achieve serious and thoughtful board-level attention to the Company’s risk management process and system, the nature of the material risks faced by the Company, and the adequacy of the Company’s risk management process and system designed to respond to and mitigate these risks.

Board Leadership

Leadership of the Board is essential to facilitate the Board acting effectively as a working group to the benefit of the Company and its performance. As Chairman of the Board and our lead independent director, Mr. Kurt J. Hilzinger assumes key duties to ensure effectiveness and collaboration in all aspects of the Board’s role.

| ||

|

| |

|

The Board believes the advisability of having separate or combined chairman and chief executive officer positions is dependent upon the strengths of the individual or individuals that hold these positions and the most effective means of leveraging these strengths, in light of the challenges and circumstances facing the Company, which may change over time. At this time, given the composition of the Company’s Board, the effective interaction between Mr. Hilzinger, as Chairman, and Mr. Broussard, as Chief Executive Officer, Mr. Hilzinger’s status as an independent director and previous service as our Lead Director, and the current challenges faced by the Company, the Board believes that separating the chief executive officer and board chairman positions provides the Company with the right foundation to pursue the Company’s strategic and operational objectives, while maintaining effective independent oversight and objective evaluation of the performance of the Company.

Board Engagement and Undertakings

The Board holds itself to a high standard of engagement, with a hands-on approach that leads to critical insights regarding our customers, operations and business and enhances their level of governance and oversight. An essential component to the Board’s engagement is communicating with the Company’s internal and external stakeholders. To accomplish this, meetings of the Board may be held in key Company markets where, together with management, the Board will personally meet with associates, customers, providers and other stakeholders to gain direct feedback into the Company’s operations, experiences and overall effectiveness. Despite continued COVID-19 restrictions and the Company’s workforce having remained primarily work-from-home, the Board maintained its commitment to engagement and continued to meet with stakeholders virtually, by videoconference and teleconference.

Certain other engagement practices of our Board are described below.

Follows an annual topical calendar used to balance strategic, operational, compliance, and cultural matters, among others, and receives detailed reports on those topics, in addition to ad hoc subjects, throughout the year.

Utilizes clear and proactive Board meeting agendas to achieve high productivity at each meeting.

Holds executive sessions during every meeting, with the CEO present and then with only the independent directors. Relevant feedback is then reported to the CEO and the management team, creating a feedback loop from the Board to the management team.

Maintains regular communication with the CEO and management team, apart from formal Board meetings, to ensure consistent and continuous progress toward established goals.

Employs Board technology tools to review Board materials and to remain informed of ongoing Company endeavors, to efficiently communicate with the management team and to take formal action when necessary.

Performs in-depth organizational structure reviews, through the Organization & Compensation Committee, of line and functional teams within the Company to assess leadership bench strength, culture, succession planning, diversity and related matters, and engages regularly with rising leaders within the Company. In addition, the Organization & Compensation Committee regularly reviews associate engagement scores, which maintained momentum during 2021, with 89% of our associates saying that Humana is committed to their health and well-being.

Receives continued education from external consultants on a wide range of industry topics to keep them apprised of the latest trends and anticipated future trajectories. In addition to our director’s individual pursuits, Board education opportunities during 2021, included, (i) a formal education session with external consultants; (ii) guest speaker attendance during select meetings; and (iii) routine briefings on regulatory developments.

|

|

|

|

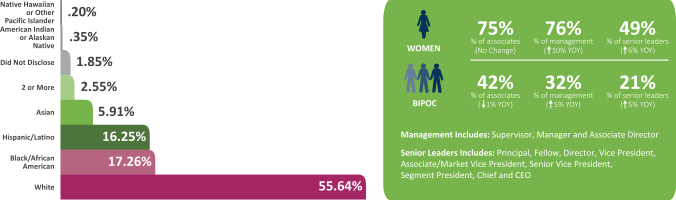

Our associates are essential to our Company’s success in delivering on our core strategy, creating positive healthcare experiences and providing human care for our members. We are committed to recruiting, developing, and retaining strong, diverse teams, activelypromoting a culture of inclusion and diversity to foster a workplace where all associates feel they can be authentic and bring their whole selves to work every day – cultivating uniqueness and thriving together.

These efforts are overseen by our Board of Directors – which has designated to our Organization & Compensation Committee the responsibility for Board-level oversight of the Company’s human capital management and inclusion and diversity policies and practices – and implemented under the direction of our Chief Administrative Officer. As of December 31, 2021, we had approximately 95,500 associates and approximately 1,400 additional medical professionals working under management agreements primarily between us and affiliated physician-owned associations.

|

| |||

| ||||

Listening to the voice of our associates reinforces our Value of Rethink Routine. We send pulse surveys to associates throughout the year to get feedback on how we’re doing, allowing us to assess our approach to work and take action when needed. We believe this helps to strengthen our culture and support associate engagement. It was through this process that WorkLife Reimagined was formed – our latest work style model that’s focused on flexibility and collaboration. We’ve learned that there isn’t just one way to operate or one way work gets done. That’s why WorkLife Reimagined includes work styles that benefit everyone and will continue to guide and shape our culture. As our associates transition to their new work style we’re equipping them with the tools they need to be successful – whether working at home, the office, in the field or a hybrid style – they’ll stay connected no matter where they sit.

Strong Company culture starts with leadership at the top. Our CEO inspires Company culture by sending a weekly Company-wide email where he engages with associates on a variety of topics including business matters, current events, health and well-being, family and personal interests. A survey link is included within these communications encouraging associates to speak up and share their own experiences directly with our CEO.

Inclusion and Diversity

Celebrating diverse backgrounds and creating an environment of inclusion is at the heart of Humana. We take intentional steps to nurture a culture where all employees, no matter who they are, feel like they can be their best selves and do their best work. Only then can we make the best decisions for our customers to ensure that they all have a fair and just opportunity to be as healthy as possible.

Our associates’ vast experiences and perceptions—their unique characteristics, backgrounds and beliefs—drive the groundbreaking, strategic thinking that gives our Company its competitive edge in a diverse marketplace. Our approach fosters innovative thinking and creativity, expands insights and generates better business outcomes.

We are committed to having balanced diversity at all levels of the Company and have developed a pathway for top, diverse talent within our recruiting initiatives. To achieve our recruiting and hiring goals we proudly partner with local and national advocacy groups, including the CEO Action for Diversity and Inclusion, the Catalyst CEO Champions for Change, and the OneTen Coalition, to provide information about open roles, assistance with resume preparation and application submission, and to design and execute other talent acquisition and development initiatives. We’re proud to be recognized as a Military Friendly employer. Under our Veterans Hiring Initiative we partner with dozens of organizations for veteran recruitment, including the Wounded Warrior Project, United States Army Reserve, and Paralyzed Veterans of America, and have hired thousands of veterans and military spouses. We have also designed and implemented programs that enhance our hiring initiatives aimed toward women in technology, retiree/mature worker populations, and closing the hiring gap of persons with disabilities versus those without disabilities.

We’ve also incorporated balanced interview panels into our interview process, through which we strategically engage a broad spectrum of interviewers that bring greater diversity and perspective. This proven best practice strengthens the candidate experience and hiring of diverse talent, ensuring we get the right talent for any given role, and minimizes the potential for personal blind spots when evaluating candidates. Balanced interview panels enhance the experience of interviewees and demonstrate our Values in action.

|

|

|

|

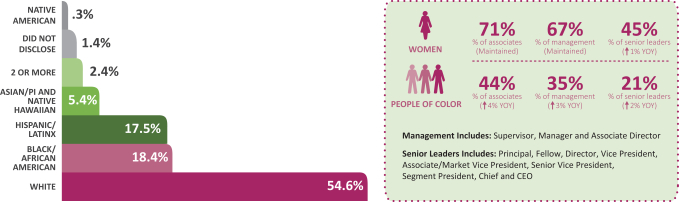

We’re committed to building balanced diversity at all levels of the Company through a focused effort on supporting a pathway for top, diverse talent, strengthening current collaborations and forging new partnerships. Achievement in this area requires a mindset of shared accountability and commitment to enterprise outcomes. In 2020, Humana leaders aligned to high-level goals – hiring and promotion of diverse talent, retention of diverse senior leadership (VP and above), inclusion, mentoring and leaders participating in conscious inclusion training – with shared accountability focused on driving inclusion and diversity throughout the enterprise. We’ve employed a metrics-driven approach to address areas of improvement quickly and goal achievement is linked to executive compensation (refer to section entitled “Compensation Discussion & Analysis – Associate Incentive Plan” within this proxy statement for more information on executive compensation). Since introducing these shared accountability measures, we’ve seen year-over-year (YOY) improvements among our female associates and associates of color. Our workforce representation is tracked through self-disclosure by our associates, and are committed to transparent disclosure of our demographic data. The charts below represent our workforce demographics as of December 31, 2021.

| ||||

| ||||

|  |  | ||||||

|

|

|

|

Talent Development and Growth Opportunities

We champion the individual goals and development of our associates, and provide a number of programs to ensure that our associates have the resources and support they need to deliver on their passion. The Humana Learning Center gives our associates the opportunity to earn professional certifications through continued education programs and to participate in instructor-led and online courses designed to strengthen soft and hard-skills and enhance leadership development. Our Career Cultivation team sponsors workshops and events to promote associate accountability within their personal and professional growth as part of overall career development. In 2021, our associates averaged approximately 35 learning and development hours per active associate.

Our associates are also encouraged to participate in mentoring programs with people of various backgrounds and cultures. We view mentoring as an essential development tool for sharing skills and knowledge so we can all succeed. Our commitment to mentoring feeds the successful future of our Company. In 2021, our associates participated in more than 2,700 mentoring circles, underscoring the Company’s focus on creating a culture of mentoring and inclusion. We also utilize development programs to enhance talent within our business segments through targeted internal initiatives, where we aim to upskill and reskill existing associates for opportunities in new career pathways.

|

|

|

A Workplace With Purpose

Having a purpose and a connection to a community improves well-being. That’s why we strive to make it easy for our associates to give back, either as individuals or a team, to causes that ignite their passion and sense of purpose. Volunteerism is a tangible way to impact the health and well-being of the communities we serve and enrich our workplace.

We’ve created programs and practices to make volunteering easier and more vibrant for associates.

Our full-time associates annually receive eight hours of paid Volunteer Time Off (VTO)

We help associates discover and track volunteer opportunities through our Humana Together volunteer portal

We integrate volunteerism in our leadership development and team-building

We offer a matching charitable gift program through The Humana Foundation

We feature associates sharing their volunteerism stories on our Intranet to inspire others

We offer our associates paid time off to get vaccinated, including boosters, for COVID-19, helping to reduce barriers associates may have in taking time away from work to get vaccinated and supporting healthy communities

Board Oversight of Environmental, Social and Governance Matters

The Nominating, Governance & Sustainability Committee has responsibility for Board-level oversight of the Company’s ESG strategy, practices and reporting. The Nominating, Governance & Sustainability Committee receives formal ESG reports from management at least twice annually regarding the Company’s ESG initiatives, metrics and progress on established goals, as well as, ad hoc ESG communications as necessary. In addition, we have an internal ESG Steering Committee, overseen by our Chief Administrative Officer and Chief Legal Officer, to guide the integration of our ESG efforts with our long-term business strategy. This ESG governance structure complements the long-standing responsibility of our Board and each of our Board committees in overseeing various aspects of the Company’s ESG-related risks and practices, as illustrated below:

| ||||||||||||

| ||||||||||||

|

| |||||||||||

|

|

|

| |||||||||

| ||||||||||||

| ||||||||||||

|

Strategic Focus on ESG

We realize that the future of our business is linked with the well-being of our associates, members and patients, the communities we serve, the healthcare system, and the environment. It’s with our stakeholders in mind that we’ve established five key pillars of our ESG program that align to our strategic business goals, supporting our commitments to sustainable business and improving health outcomes. These pillars – Access to Healthcare; Data Privacy & Protection; Environmental Impact; Product Quality & Safety; and Talent & Diversity – are the driving force behind our impact platform and will guide our ESG program.

We’ve developed quantitative and/or qualitative metrics within each pillar to track, monitor, measure and report our performance. Transparent disclosures are a top priority, as such, we’ve mapped our ESG disclosures to frameworks established by the Sustainability Accounting Standards Board (SASB) Managed Care Standard, the Task Force on Climate-Related Financial Disclosures (TCFD), and the Global Reporting Initiative (GRI). We also support the United Nations Sustainable Development Goals, aligning our efforts to three goals where our Company can most contribute: Goal 3 – Good Health and Well-being; Goal 8 – Decent Work and Economic Growth; Goal 12 – Responsible Consumption and Production.

Our Impact Platform

We’ve set our intentions to have a positive well-being impact among all of our stakeholder groups and have developed a platform where we believe we can make the most difference. Our impact platform sets the direction for how we will advance health equity, address needs in our communities and drive sustainable change with shared value. The pillars may connect to one or more categories within the impact platform, reinforcing the interconnectedness of our holistic approach to ESG. We’ve highlighted below key elements of our ESG program along with some of our notable pillar metrics.

|  |  |  | |||

|

|

|

| |||

For Each Person

Our members achieving their best health is at the top of our mind. We know that health is not linear. Every member is unique as are the communities we serve. That’s why we’re continuously working to ensure that our health plan products and services are as affordable as possible, as well as, addressing access to healthcare barriers so that all of our members can receive the care they need. As we cultivate our philosophy of whole-person health care, we’re addressing the most crucial needs of our members, which means truly caring about them, understanding what is important to them and finding ways to make it easy for them to live their best life. Thanks to processes such as integrated care delivery and using health screenings that consider social determinants of health, we have a clearer view of each member’s very personal barriers to their best health. Through our integrated approach, we are building the tools to address the physical, behavioral and social factors that all play such a critical role in promoting improved health outcomes. Please refer to our Value-Based Care Report for more information on these efforts.

|

Our associates are the driving force behind our Company’s well-being initiatives. We believe that when we invest in our associates they pay it forward by investing in others. In this effort we actively live out our Values, cultivating uniqueness and thriving together.

|

|

To help integrate inclusion and diversity into the fabric of the organization from the top down, the Council is led by our President and CEO, with top priorities consisting of (i) leading and informing the strategy to drive the hiring, developing, promotion and retaining of our full diverse workforce; (ii) creating and maintaining an inclusive culture; (iii) reviewing our supply base and spend for diversification opportunities; and (iv) improving transparency and accountability to sustain outcomes. The Council sets company-wide inclusion and diversity goals and objectives that complement our Talent & Diversity pillar.

Our inclusion and diversity objectives also aim to build an awareness of biases and beliefs, identify differences and similarities of our multi-generational workforce and enable associates to leverage differences to drive innovation and create value. We are committed to growing our associates’ inclusion skills and diversity knowledge and provide a variety of associate training programs and workshop opportunities in areas of unconscious bias, disability awareness, cultural competency, racial equity, and social justice, among others.

|

KEY PILLAR METRICS

|

|

For Each Community

We recognize that we are part of a bigger community – one that is connected to our members, patients, employees and neighbors. We are dedicated to the holistic health of all people, and that is why we invest in communities across the country to advance health equity. Health equity is about making sure we all have a fair and just opportunity to be as healthy as possible. Helping communities and the people in them grow stronger benefits all of us, because where people live, work and play is inextricable from their health outcomes. We’re partnering with communities to advance health equity on a local level and take on the social determinants of health that impact all of us.

As our Company shifts from an insurance company with elements of health to a health company with elements of insurance, we are focused on five areas of influence to help improve health and aging: primary care, home health, pharmacy, behavioral health and social determinants of health. Championing this effort is our Bold Goal – a population health strategy launched in 2015 to improve the health of the people and communities we serve by creating solutions to address unmet social needs and making it easier to achieve their best health.

Since 2015 we’ve continued to adapt as we learned more about our communities and our members. We discovered how important it is to develop personalized solutions, determining how best to meet the needs of our members while striving to (i) help Humana and its partners understand social determinants of health and their prevalence in our communities; (ii) convey how such determinants actualize into social needs that limit or prevent health care; and (ii) create impactful care solutions that account for our members specific health-related social needs. That has meant getting to know our members better and the daily health-related challenges they’re facing in order to connect them to people and organizations who can support them – not only in their clinical needs, but also in their individual health-related social needs,

|

such as getting access to healthy food, helping to connect them socially and addressing their housing needs. With community-based organizations and healthcare practices, we are creating evidence-based, scalable and financially-sustainable solutions to improve population health at a local level. We’ve scaled social determinants of health screenings across our business, which has impacted millions – connecting those in need to community resources and support.

Because we know social determinants of health play a significant role in addressing health needs, we have developed a variety of programs, services, benefits and resources for members and the public. Our Far From Alone campaign, with many partners, strives to improve the mental health and wellness of others by increasing social connectedness and reducing feelings of loneliness. The campaign drives awareness, action, and advocacy in support of addressing this important social determinant of health. Learn more about our Far From Alone campaign, and how you can get involved, at its website https://farfromalone.com.

|

|

KEY PILLAR METRICS

|

|

For Our Business and the Collective Healthcare System

Throughout our operations, we are dedicated to ensuring that every business decision we make reflects our commitment to improving the health and well-being of our members and patients, our associates, the communities we serve, and our environment. Our holistic, integrated approach to care and longstanding commitment to caring for vulnerable populations also afford us a unique opportunity to promote health equity and address the effects of health disparities in the U.S. healthcare system. We have established policies and programs that illustrate our commitment to responsible business practices that lead to a more efficient, equitable and sustainable healthcare system.

Our suppliers are essential to delivering services within our business, which is why we incorporate ESG principles into our procurement strategy - ensuring a fair and equitable approach to procurement. We understand that partnering with diverse suppliers and small businesses, and engaging with them to support common ESG goals, can lead to future sustainability and a reduction in environmental costs. We also understand that inclusive procurement practices deliver broad societal benefits by creating economic opportunities for traditionally underserved or underrepresented groups. That’s why we’ve made it a priority and strive to attract qualified, certified suppliers who reflect our customers, associates and communities we serve. Leveraging these suppliers now and in the future is a win-win for everyone.

Our Supplier Diversity Program promotes an inclusive approach to procurement that ensures we invest our dollars with a balance of partnerships with historically underutilized businesses. We also support the growth of small and diverse-owned businesses by being a resource partner for them, and during 2021 we launched a Supplier Diversity Mentor-Protégé program. The program is a 12-month pilot with half-day, onsite seminars featuring leadership from across our organization exploring topics impacting business growth and operations of small and diverse businesses. The program is designed to identify and overcome barriers that typically inhibit or restrict the success of small and diverse businesses and better position them for growth, sustainability and inclusion.

We also survey suppliers annually through a sustainability scorecard that addresses sustainability, diversity practices and supplier performance. The scorecard is distributed at year-end to our top 50 Prime Suppliers (top spend suppliers) and we typically receive a 25-30% overall spend response rate. We also hold our suppliers accountable for complying with our Company’s Standard of Excellence and Ethics Every Day policy – to the same degree as our associates.

Our governance practices and policies reflect strong controls that provide a solid foundation for our continued success. We are committed to supporting the delivery of consistent high-quality care, promoting efficient outcomes in the healthcare system and ensuring that healthcare remains affordable for all members and patients. Further, in a healthcare industry increasingly driven by quality, we have a corporate Quality Improvement (QI) program – with practicing network physicians as members of various quality subcommittees – to monitor, evaluate and facilitate improvement in the quality of health care services provided to our members. The QI program is overseen by our Corporate Quality Improvement Committee (CQIC), which among other things, promotes alignment to the third dimension of

|

quality (experience and outcomes) through collaboration with stakeholders, personal accountability and speaking up when quality does not meet our standards.

Our associates are integral to running our Company responsibly and key to our ethics and compliance practices. That’s why all Humana associates and contractors are required to complete an annual ethics and compliance training, and why our Enterprise Compliance team places an emphasis on communicating about ethics, compliance and risk in an intentional way, throughout the year. Our Company is also committed to building digital care delivery operations and leveraging key insights from enterprise analytics. Integrating these critical capabilities across the organization will further accelerate our Company’s move toward differentiated experiences for our customers at the intersection of healthcare and lifestyle, tailored especially to the needs of seniors. We recognize that our emphasis on technology comes with great responsibility as our customers trust us with keeping their information safe. To that end, we are proud to be an industry leader in the adoption of principles and governance to guide our implementation of emerging technologies.

KEY PILLAR METRICS

|

|

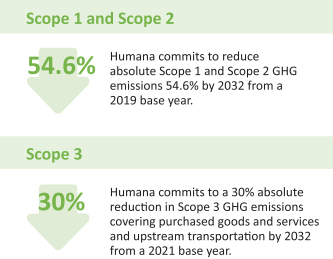

For the Environment

We know that a strategic focus on environmental sustainability is critical to fulfilling our mission of helping people achieve lifelong well- being. The better we do at protecting the health of our environments, including our operations, supply chain, and communities around us, the better we can do at positively supporting people on their health journeys. We believe that our demonstrated commitment to environmental sustainability not only positions us to offer reliable and cost-effective service to our customers, but also embodies the principle of an intrinsic link between the health of our planet, our business, and the services we provide.

As a services company, our direct environmental impacts are concentrated within our internal operations. As such, our focus is on areas where we feel we can make the most impact: energy, emissions, and waste. We augment these initiatives with a broader effort to conserve other resources such as water, manage our real estate footprint, and collaborate with our stakeholders – namely our associates – to actively embrace sustainability. We understand that climate change impacts pose risks and opportunities for our business and seek to manage such impacts in several ways, including: continuous strengthening of our already robust business continuity program, investing in energy management and efficiency projects and applying financial incentives to support efforts toward reducing our environmental footprint. We also set challenging environmental targets, as shown below, that promote collaboration with vendors and associates to achieve them. These efforts mitigate risks and demonstrate our commitment by validating the intrinsic link between environment and well-being.

Our Workplace Experience team, overseen by our Chief Administrative Officer, is responsible for day-to-day planning, coordination and implementation of the Company’s operational environmental sustainability policies, including those around energy management and climate-change mitigation/ adaptation. The Workplace Experience team also leads initiatives toward achieving environmental targets in addition to tracking/reporting progress and assessing opportunity toward setting new climate-change mitigation/adaptation targets.

We are now working with a global leader in the digital transformation of energy management and automation, to create a more robust next generation goal that will align with the Science Based Targets initiative (SBTi) to address climate change. We understand that a path forward to net zero emissions is important to our collective future and we’re analyzing tactics, appropriate to our business, that allow us to contribute to net zero goals. We expect to publicly announce our new SBTi aligned environmental goal in late 2022. We encourage you to review our Environmental Sustainability Policy Statement and our 2021 CDP Report to learn more about our sustainability efforts and areas of concentration.

|

|

KEY PILLAR METRICS

|

|

ENVIRONMENTAL SUSTAINABILITY INITIATIVES

|  | |||||||||||

|

| |||||||||||

| ||||||||||||

|

| |||||||||||

|

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Corporate Responsibility Awards and Recognition

We are pleased to have received recognition for our 2021 corporate responsibility and ESG efforts and we appreciate the acknowledgement of our commitment to inspiring health and well-being. Highlighted below are just a few of our valued achievements, however a complete list of awards and recognition is available on our website at www.humana.com – from there click “Corporate Responsibility” and then click “See Our Awards.”

|

Board Evaluation Practices

The Board is committed to a rigorous self-evaluation process. Through evaluation, directors annually review the performance of the Board and each committee, as well as their own individual contributions, including areas where the Board feels it functions effectively, and most importantly, areas where the Board can improve. The Nominating, Governance & Sustainability Committee, with participation from our Chairman and Chief Executive Officer, initiates the annual Board evaluation process. We believe that having a review process for each group helps to (i) ensure an adequate representation of requisite skills; (ii) encourage high levels of engagement from directors; and (iii) strengthen the overall effectiveness of our Board. Results of the evaluations are shared with the Chairman of the Board and the Chairman of the Nominating, Governance & Sustainability Committee and then later discussed with the entire Board in an aggregated manner, with agreed upon actions and improvements then implemented and monitored for effectiveness.

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

The Guidelines contain standards to assist the Board in its determination of director independence. In addition, to qualify as independent under the Guidelines, the Board of Directors must affirmatively determine that a director has no material relationship with the Company, other than as a director.

Pursuant to the Guidelines, the Board undertakes an annual review of director independence. During this review, the Board considers transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates, including transactions or relationships that are reported under “Certain Transactions with Management and Others” in this proxy statement. As provided in the Guidelines, the purpose of this review is to determine whether any such transactions or relationships are inconsistent with a determination that a director is independent.

In the course of this review for the current year, the Board specifically analyzed and discussed several matters:

|

|

|

|

|

|

|

|

Fiserv. In 2021, we contracted for certain marketing and advertising services from Fiserv in connection with member communication materials for which we paid approximately $12.15 million, which is comparable to other non-affiliated vendors for the provision of similar services, is not material to the Company, and does not represent a direct or indirect material interest to Mr. Bisignano.

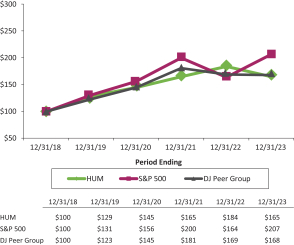

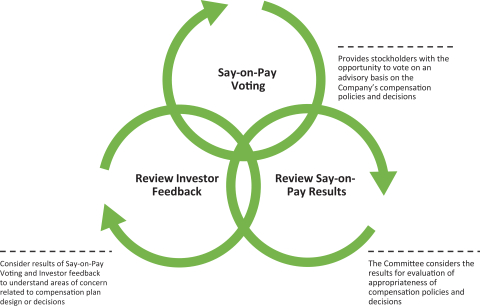

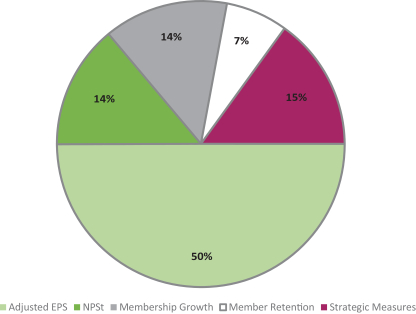

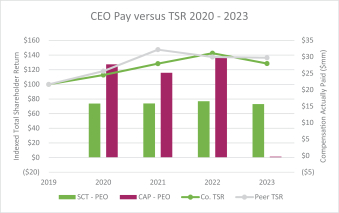

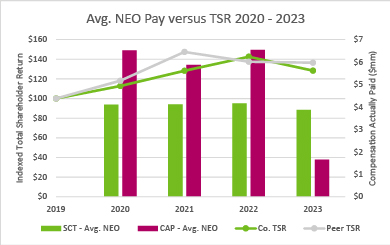

Pfizer. The relationship between the Company and Pfizer includes a negotiated rebate based on the volume of prescriptions of Pfizer drugs obtained by Humana members, which volume includes claims paid by Humana for our members and the co-payments paid by our members. Payments to Humana from Pfizer result from activity with many intermediaries over whom Humana exercises no control (i.e., the providers who prescribe these medications, the distributors who sell to the retailers, and the retailers from which our members get prescriptions). In 2021, the Pfizer rebates amounted to approximately $71.3 million, substantially all of which were passed through to our members in the form of lower premiums and/or higher benefits. Our subsidiary, Humana Healthcare Research, Inc. or HHR, has also contracted with Pfizer to complete various research studies at commercial rates and following our standard protocols; HHR received approximately $250,750 in fees from Pfizer for this service in 2021. The Company also received approximately $254,250 from Pfizer during 2021 related to hanger rental and other associated aircraft incidentals. The relationships described herein did not represent a direct or indirect material interest for Mr. D’Amelio.